LHDN Approved Payroll Software

BMO Payroll Monthly Tax Deduction (MTD) using Computerized Calculation Method has been approved by Lembaga Hasil Dalam Negeri. Our payroll solutions are fully compliant with all local regulatory standards in Malaysia. Automate your EPF, SOSCO, EIS, HRDF, and PCB calculations. Integrated with attendance, e-Leave, and e-Claim modules which eases your entire process of payroll calculation.

BizCloud HR Suit Payroll Module Features

Generate monthly payroll from the web

EA form can be generated year-end

Leave balances and claims will be reflected in payroll

Generate, modify, and print payroll for every employee

Take claims, attendance, and leave into the calculation of payroll

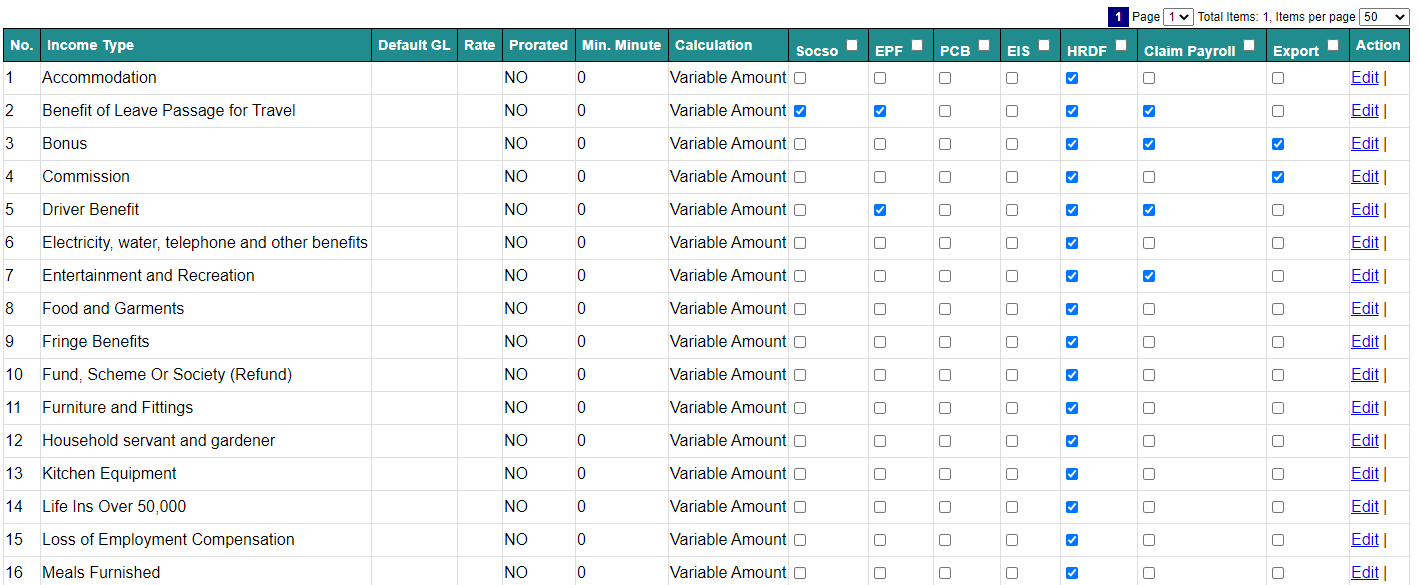

Follow strictly to government legislation for SOCSO, EPF, EIS, Income Tax, etc.

Customize the behavior of the automatic calculation in the payroll system

You can choose to print it or generate it as a PDF for your employee to view from the payroll system

Payroll calculations take deduction limits such as EPF, SOCSO, Income Tax and EIS into account

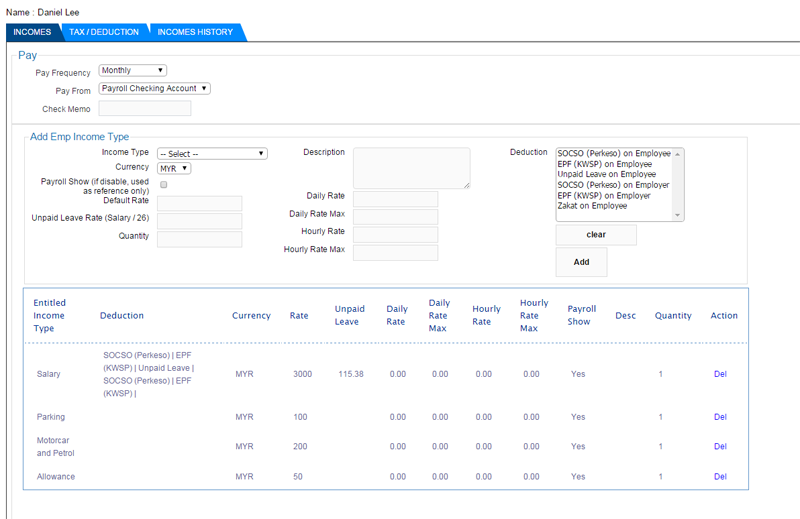

Employee Income Type

- Define income type for every employee

- You can choose to display a particular item on the pay-slip or otherwise

- Daily wages are calculated automatically and to be deducted if any unpaid leave is taken

- You can define which income type is eligible for SOCSO, EIS, PCB from the system

Payroll Module As Standalone Software

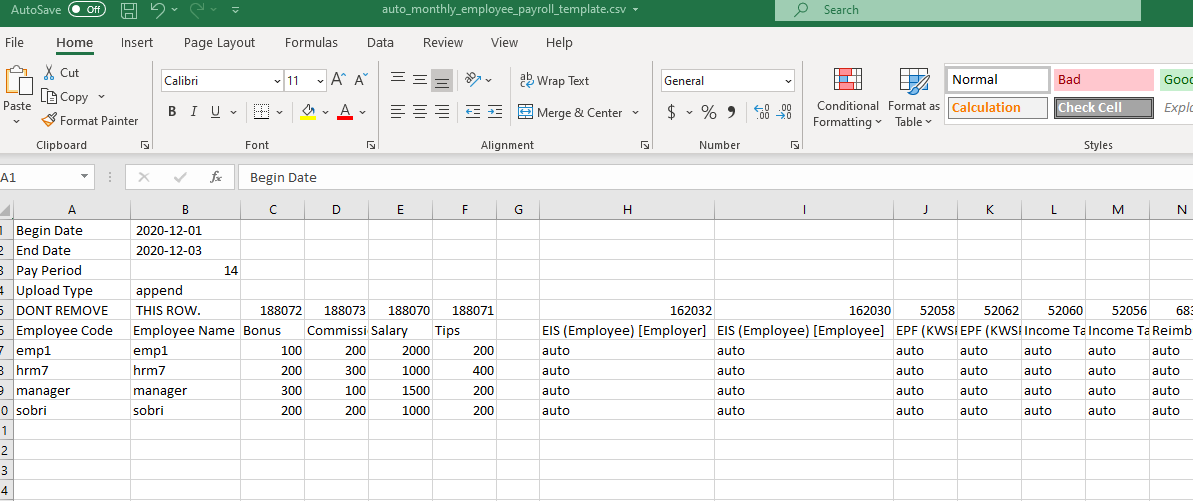

- Generate from the application

- Uploads Excel to generate pay-slip

Payroll Module

Payroll With Time Attendance, e-Claim And e-Leave Modules

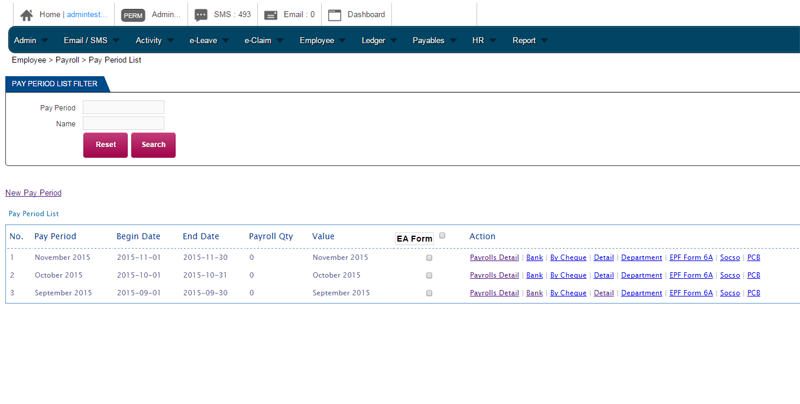

Pay Period List

Past payroll data are kept in the payroll system. Payroll software helps HR administrators to keep track of all employees’ records and prepare for payroll auditing.